The pharmaceutical industry wouldn’t thrive to the extent it does without having the ability to manufacture at such a large scale. “A typical lot of Tylenol may have several million capsules in it,” says cell and gene therapy consultant William Janssen. “But Johnson & Johnson probably only makes half a dozen lots a year.” These numbers are unlikely to square with manufacturing dossiers at J&J; after all, Janssen didn’t spend a lifetime working there, a fact that couldn’t be made more evident when he doesn’t refer to the pharmaceutical wing of the medical device giant by its correct name (Janssen), even though it’s the exact same as his own. He did spend it researching and producing cancer therapeutics though, which is why his next statement illuminates how much the cell and gene therapy sector differs from its much larger sibling: “One lot of CAR-T cells is a single dose. We need two people per dose, with two weeks to make a dose, and there’s only 52 weeks in a year – that’s 26 doses a year.”

To an extent, long lead times are an inherent limitation of manufacturing a product using living matter, especially when the process involves differentiating cells from one lineage to another. “Because these are typically based on how nature does it, you can only force it and mimic it to a certain extent,” explains James Kusena, head of bioprocessing at MicrofluidX. “If you can fine-tune the process then you can shorten it, but you’re not going to drastically turn a 14-day process into one day.”

Where you can improve your lead times, he says, is by scaling up. The problem, of course, is that creating products that require such forensic diligence on a larger scale requires more skilled hands. “The folks I’ve spoken to at the companies involved in this say their single biggest rate limiter right now for production is that they can’t get enough people to do the manufacturing,” says Janssen. Add to this that the FDA expects to approve between ten and 20 cell and gene therapies a year by 2025, and it becomes abundantly clear why manufacturers are desperate for talent.

What about automation?

As with the manufacturing sectors in numerous other industries, there’s no shortage of buzz around the prospect of automating parts of the cell and gene therapy production cycle. It’s not without good reason either. As well as the increase in speed and output gained through automating, a more standardised manufacturing process can tackle one of the biggest issues the sector currently has – variability.

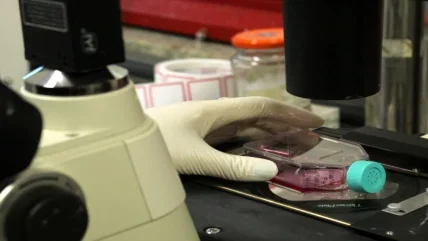

“What I think is the right pinkness of the media, or confluency of the cells, will be different to what you think, or what person x, y or z thinks,” says Kusena. “We can all have the same years of experience and still see things differently.” Unlike in a more traditional manufacturing setting, where human error might result in the scrapping of one of thousands of products, in cell and gene manufacturing, it can be the difference between a patient receiving their last resort in time.

In worst-case scenarios, Kusena says the process can fail completely, carrying with it a cost to the business that can run into tens of thousands of pounds due to the high price tags on reagents used. In his own research, Kusena found that the seeding density of cells into a growth medium can be particularly sensitive, causing many of the batch failures he says are a big problem in the current state of manufacturing.

Automation has the potential to improve this failure rate by “removing the need for people to think,” says Kusena, whose employer is a start-up actively working on a machine that can do just this. “That’s not a negative thing, because when you’re manufacturing, you want your process to be as standardised and robust as possible,” he adds. “You don’t want to have to make decisions that are probably going to cause variation, because we’re working with a biological entity that is already variable itself.”

The ideal scenario envisioned by Kusena is one in which the skill level required for cell and gene therapy manufacturing is reduced by implementing automation guided by a rules-based set of protocols, with the process overseen by the PhDs and research associates that currently do much of the manual labour. The caveat here is that facilities aren’t going to automate overnight. Sarah Stoll is director of Project Farma, a cell and gene therapy manufacturing consultancy, and she also extols the virtues of automation, even extending them to include the ability to create a digital record of manufacturing, something that’s becoming more sought after by regulators. But although she sees the sector increasing its use of automation “day by day”, she says it still has a long way to go before the process stops being a predominately manual one.

“There’s a little over 1,200 clinical trials worldwide, and about half of those are in the US. Over 100 of those are in phase III, so we’re getting really close to getting more approved.”

Sarah Stoll, Project Farma

10–20

New cell and gene therapies expected to be approved by the FDA per year by 2025.

Food and Drug Authority

The right people for the job

Until automation reaches anywhere close to a saturation point in the cell and gene therapy manufacturing market, companies producing these next-generation pharmaceuticals are going to be fighting the same staffing battle they have for years, with the predicted influx of new therapies heaping on even more pressure. “There’s a little over 1,200 clinical trials worldwide, and about half of those are in the US,” says Stoll. “Over 100 of those are in phase III, so we’re getting really close to getting more approved.” Meanwhile, Stoll says the skill shortage isn’t slowing down, especially with Covid creating a demand for similarly skilled personnel in vaccine production.

In the UK, the springboard organisation CGT Catapult runs apprenticeships aimed at school leavers to create a pipeline of talent into the manufacturing side of the industry. But in the US, most companies still require applicants to have a four-year college degree in chemistry or biology, so that they come to the manufacturing facility with a basic understanding of laboratory science. “If somebody comes into a cell-processing lab and they don’t know how to use a microscope, they’re going to have a hard time finding a cell,” says Janssen.

But despite this, he believes a potential solution to the skill shortage is casting the net for applicants wider and being more willing to provide training to those who haven’t stepped foot in a lab. “It’s conceivable that somebody with the critical thinking skills required for getting an undergraduate degree in philosophy, with a little extra education, could be trained to do cell and gene therapy manufacturing,” he says. One avenue Janssen believes could be used to provide this additional training is community colleges, and he says there’s already ambitions within the industry to form partnerships with them. “Desperation breeds enthusiasm,” he chuckles. “The companies are certainly realising they’re going to have to invest in this area.”

A long shot

Despite the undeniable benefits of automation, the move from manual to machine-based processing might not be as smooth as some anticipate, and Janssen says that’s due to the need for another form of expertise that’s in short supply – process engineers. “There’s going to be a need for process engineers who are versed in how cells grow and how gene vectors enter cells, as well as the things that inhibit the efficiency of both,” he says. “I already know that there’s a shortage of such folks.” On the manufacturing side, there’s still hope that the skills gap will be closed, but not an awful lot of belief that it will. “It’s going to be at a steady state in the same position we’re in now for a while,” says Stoll.

Kusena is more optimistic about the UK’s cell and gene therapy sector, having seen an uptick in the number of people coming into the industry without a PhD, but instead with training provided through programs like CGT Catapult’s apprenticeships. While it used to be the case that PhD educated staff were necessary to understand the process and make changes to it, he says “now, the more it’s being standardised, the easier it is to write a standard operating procedure that somebody can just follow, with a senior supervisor there to respond to more technical issues.”

Janssen, who describes the subject as being “near and dear to my heart”, hopes to see the industry embrace students from outside of science in the US too. For the moment, he concludes his thoughts on a sombre note: “The number of people who could benefit from CAR-T therapy is probably somewhere between ten and 50-fold greater than the number who currently have access to it,” he says. “If we cannot disseminate these kinds of therapies to a larger population, we’ve really not accomplished all that much.”

It’s not all CAR-T cells

Although they tend to dominate the conversation due to the leaps in research and positive clinical applications they’ve had, CAR-T cells are one of many cell and gene therapies. “CAR-Ts have the limelight right now,” says Kusena. “Other therapies aren’t getting as much because there isn’t as much evidence to support them.” Kusena’s own work during his PhD was centred on dopaminergic neuron progenitors – a stem-cell derived therapy with the potential to treat Parkinson’s disease. “That’s basically taking embryonic stem cells differentiated into neurons and then implanting them into patients,” he says. Bluerock Therapeutics, a subsidiary of Bayer, is also conducting research into the viability of these cells as a treatment for Parkinson’s, and it had an Investigational New Drug (IND) application cleared by the FDA in January.

Although most of them are CAR-T cell therapies, there are a few FDA-cleared products that target other maladies. One of these has been cleared for clinical use in the US since December 2016. Maci, an autologous chondrocyte implantation therapy, is used to replace cartilage cells in the knee to repair damage. Another osteo-related therapy approved by the regulator is Zolgensma, a single-dose treatment for spinal muscular atrophy, which kills 90% of untreated infants before age two.

The $2.47m price tag on Zolgensma drives home the challenge inherent within the field of cell and gene therapy. Although the full list of approved FDA products runs to 22, with many more expected to be cleared in the near future, unless manufacturers find a way to scale up production, the cost will remain prohibitive.