The first CAR T-cell therapies were only approved by the FDA in 2017. Yet over less than a decade they’ve already transformed the fight against some of the nastiest diseases around. Consider B-cell lymphomas, a vicious form of blood cancer that could often see patients live for just six months after diagnosis. With CAR T-cell therapies, 50% of patients have seen the disease go into remission, with many surviving for 18 months or more. It’s a similar story with the most aggressive forms of leukaemia. From an average life expectancy of just seven months, the majority of victims can now expect to live for a year or more.

With statistics like this it’s no wonder experts are so excited by the technology. For Federico Rodriguez Quezada, an expert in the CAR T-cell therapy supply chain, it represents nothing less than “a second chance in life to conquer cancer.”

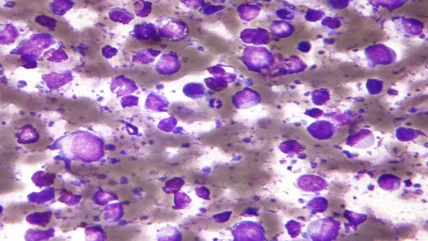

Fundamentally, these successes can be understood in terms of the unique way CAR T-cell therapies operate. Rather than being fed massproduced medications, or else doused with radiation, therapies are instead deeply personalised. T-cells are taken from patients’ blood and genetically modified to find and kill cancer cells. Once medical professionals return these adapted cells to do battle against the disease in the bodies of patients, they use various cytotoxic mechanisms to eliminate the cancer cells. These mechanisms include the release of perforin and granzymes, which create pores in the cancer cell membrane and induce apoptosis (programmed cell death). CAR T-cells can also express cell surface receptors that directly induce apoptosis in the cancer cells. The results of this customised approach are still being evaluated in clinical trials, with one academic paper finding 1,087 CAR T-cell clinical trials were in operation according to ClinicalTrials.gov as of February 2023. According to work by Acumen Research and Consulting, for instance, the CAR T-cell therapy industry is set to enjoy CAGR of 24% through 2032. That’s shadowed by growth in specific countries: In the United States, researchers expect the sector to reach $7bn over the next decade.

But while interest in CAR T-cell therapies abounds, they equally cause vast challenges in the supply chain. That’s not hard to understand. Rather than drawing a straight line from factories to patients like with small molecule drugs, CAR T-cell therapies must instead travel from patient to manufacturer – and back again. And if that inevitably causes bottlenecks, there are other problems too. From a lack of trained staff to a bewildering variety of extraction protocols, insiders must overcome a range of hurdles before patients can finally enjoy the benefits of personalised cell therapy. Even then, the costs involved remain eyewateringly high for many, particularly when such a booming field leaves little space for collaboration.

Blood supply

Few people are better placed to explore the difficulties of the CAR T-cell therapy supply chain than Quezada. An industry veteran of more than three decades, he began his career overseeing the technical operations of a blood bank. Since then, he’s worked on everything from stem cells to quality control. Now a self-employed transfusion medicine and cell therapy consultant, he well understands the strengths of CAR T-cell therapies. Yet if his enthusiasm at “second chances” speaks vividly to the medical miracles these technologies promise, he is equally conscious that none of it is easy. Most fundamentally, the issues start with the supply chain. Compared to regular medications, Quezada explains that the latest blood therapies add “one more step to the chain, because you have to collect the cells first from the patient, and then send them to the manufacturing facility like any other raw material”.

Unfortunately – in the US, obviously – many of the pharmaceutical companies are trying to reimburse their shareholders.”,

Dr Jeffrey Winters

In practice, that predictably slows down the time it takes for patients to get treatment. Depending on the precise manufacturing method, that can take about a month, hardly ideal when early treatment is crucial to survival. Nor is this back-and-forth supply web the only bottleneck. For one thing, the machines to extract blood samples, known as apheresis units, are often hard to use. This isn’t so much down to the devices themselves as it is to the demands of manufacturers – though it doesn’t help that nursing courses normally don’t cover them. From extracting different blood volumes to specific counts of white blood cells, Dr Jeffrey Winters says that nurses are expected to master a bewildering range of extraction methods. As the Mayo Clinic specialist continues, that means nurses need about six months of training before they can use apheresis machines confidently – a number that rises to twelve months for more complex procedures.

There are troubles at the other end of the supply chain, too. While demand is soaring, CAR T-cell therapy manufacturers are struggling to keep up. This is unsurprising: Quezada warns that with the best will in the world, it can take months or even years to build new facilities, while the needs of patients continue to rise. To make matters worse, different pharmaceutical firms have developed distinct ways of actually creating their therapies, even as manufacturers oblige nurses to fill out a frustratingly motley set of online forms. “Each of the web portals is a little bit different for what the nurse has to put in there,” is how Winters explains it, adding that even the information nurses are expected to write on cell packets can vary by company.

In one cell swoop

What can be done to widen these chokepoints? In the first place, Winters describes an informal system of industry contacts, whereby doctors will contact manufacturers to argue the case of individual patients. This disorganised lobbying process can sometimes feel farcical. If, for instance, an individual becomes too unwell to use their manufacturing slot (efficacy notwithstanding, CAR T-cell therapies can be brutal on the body), physicians may receive last-minute calls about other deserving patients. Another option involves putting cancer sufferers forward for research protocols, especially if there’s a lack of available commercial slots. No wonder Winters characterises the sector as a “lastminute scramble” for carers and patients alike.

It makes sense that insiders are casting about for more sustainable solutions too. For his part, Quezada seems especially optimistic about the scientific work being done to cut manufacturing times for CAR T-cell therapies. In particular cases, waiting periods of three weeks have been sliced to just 48 hours, a development he calls a “game changer” if done at scale. That’s echoed by yet more exciting innovations. At Penn Medicine in Philadelphia, to give one example, researchers last year announced that they’d successfully manufactured CAR T-cell therapies in less than 24 hours – clearly a potential boon for overstretched factories everywhere.

And if broad scientific developments are one way forward here, some insiders are wisely attempting to smooth over the more egregious examples of industry variation. Winters is at the centre of these developments, recently co-authoring a paper for the American Society of Apheresis pushing for increased standardisation. There’s obviously lowhanging fruit here, from those muddled web portals to the fact that some manufacturers actually expect more detailed information than officially accredited medical bodies. In the meantime, both Winters and Quezada advocate putting our collective trust in the doctors – if only to decide who needs a precious manufacturing slot first. As Quezada puts it, physicians appreciate “the condition of the patient” alongside their broader medical history. In the absence of longer-term solutions, deferring to the experts will probably have to do for the moment.

Costs and benefits

Nonetheless, hurdles remain. Perhaps the most important involves manufacturers – and their willingness to standardise. With so much money floating about the CAR T-cell therapy sector, and so many of the technical details remaining closely guarded secrets, Quezada concedes that there’s little incentive for companies to collaborate. A related problem is price. By some estimates, CAR T-cell therapies cost around $500,000 a pop, a figure that potentially rises to as high as $2m if you factor in additional costs, like training and labelling. “It requires a lot of investment,” is how Quezada laconically puts it, a point Winters makes in more strident terms. “Unfortunately – in the US, obviously – many of the pharmaceutical companies are trying to reimburse their shareholders,” he says. “And so there are a number of drugs that one wonders why they’re so expensive.”

And if these financial burdens clearly impact patients in the Western world, the situation is even worse for developing countries. As late as 2021, several years after the first CAR T-cell therapies were approved by the FDA, trials across Africa and Latin America had yet to even start. Yet, if the current sector, characterised by unregulated enthusiasm, is clearly causing issues, there’s some evidence that the same market forces could finally make CAR T-cell therapies more accessible. Already, Winters says that some doctors shop about for available manufacturing slots, a situation made easier given some treatments treat similar ailments. And with masses of new factories coming online soon – European towns from Leiden to Oxford may soon boast their own manufacturing spaces, even as US facilities continue to expand – the Mayo Clinic expert hopes that the “laws of economics” will eventually see prices fall. Given how revolutionary CAR T-cell therapies can be, you certainly have to hope so.